UNFI Delivers Solid Fiscal 2025 Results

September 30, 2025 3 minute read

Today, UNFI released fourth quarter and full year fiscal 2025 results in line with the Company’s most recent outlook for net sales and adjusted EBITDA, and above expectations for free cash flow. The Company’s solid performance was driven by the strength and resilience of its customers, suppliers and associates, combined with consistent execution of its multiyear growth strategy.

Full-Year FY25 Highlights (vs. FY24 on a comparable, 52-week basis):

Net sales: $31.8B, +4.6%

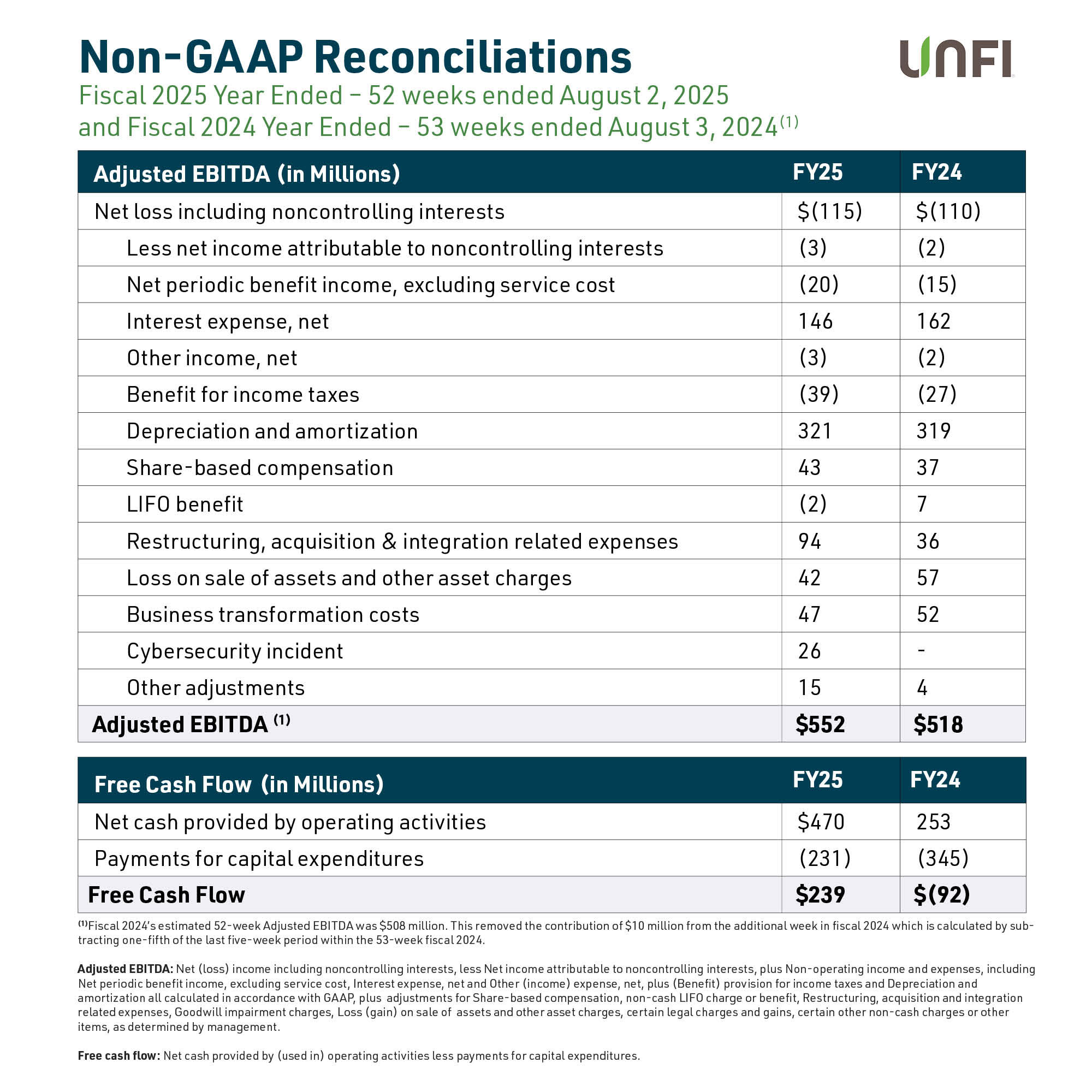

Adjusted EBITDA*: $552M, +8.7%

Free cash flow*: $239M, +$331M

*Non-GAAP financial measures. See below for reconciliations and definitions.

“In fiscal 2025, we continued to enhance our value proposition and delivered above-industry sales growth, while improving our effectiveness and efficiency,” said Sandy Douglas, UNFI’s Chief Executive Officer.

Wholesale sales growth exceeded industry benchmarks and was led by natural product growth with segment sales climbing over 9% on a 52-week comparable basis, fueled by rising consumer demand for natural, organic, specialty and fresh products.

During UNFI’s public earnings call, Douglas shared progress made in the first year of the Company’s refreshed strategy, which is anchored on two core pillars: 1) adding value for customers and suppliers, and 2) becoming a more effective and efficient business.

Adding Value for Customers and Suppliers

UNFI aims to add value for customers and suppliers by bringing them innovative products, programs, and services designed to profitably grow their businesses.

During fiscal 2025, UNFI grew its business with existing and new customers through customized product assortments and supply chain solutions to meet their short-and-long-term needs. The Company also expanded its digital and professional services, helping customers save money, operate more efficiently, and compete more effectively. These services range from credit card processing, shelf management and store remodeling to digital solutions like the UNFI Media Network and electronic shelf labels.

UNFI continued to roll out its revamped commercial go-to-market program for suppliers, which streamlines fees and adds access to proprietary insights to help them build their brands and accelerate their growth within UNFI’s retail network. The Company also created a dedicated, cross-functional team focused on continually improving the supplier experience.

Improving Effectiveness and Efficiency Across the Business

In the fourth quarter, UNFI continued to optimize its expansive distribution network while driving operational excellence. Recently, the Company invested in automation and added approximately 400,000 incremental square feet with new facilities in Manchester, Pennsylvania, and Sarasota, Florida. These investments are expected to enable growth in both regions and improve product restocking speed and order accuracy over time.

Through the end of its fiscal year (July), the Company had deployed lean daily management in 28 of its 52 distribution centers. “Our commitment to embedding lean in our business is driving ongoing and sequential benefits across safety, quality, delivery and cost. We believe the benefit of lean initiatives will continue to deliver better throughput and supply chain efficiency over time, while supporting an improved customer experience,” said Matteo Tarditi, UNFI’s President and Chief Financial Officer.

From adding new capabilities to embedding Lean processes across operations, UNFI is building a more responsive and resilient supply chain to support customer needs across a range of macro and competitive backdrops.

Positive Long-Term Outlook

Looking ahead, UNFI raised the multi-year financial objectives it announced in October 2024 for the period ending with fiscal 2027.

“We’re focused on accelerating our momentum by building on UNFI’s unique ability to provide innovative products, programs, services and well-scaled supply chain solutions that help our customers and suppliers grow profitably. We’re increasingly confident in our strategy and our path forward to generate sustainable long-term growth and shareholder value,” said Douglas.

For more details, including the Company’s Fiscal 2026 outlook, read UNFI’s press release here, or listen to the recording of its public earnings call here.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: Statements in this press release regarding the Company’s business that are not historical facts are “forward-looking statements” that involve risks and uncertainties and are based on current expectations and management estimates; actual results may differ materially. The risks and uncertainties which could impact these statements are described in the Company’s filings under the Securities Exchange Act of 1934, as amended, including under the section entitled “Risk Factors” in the Company’s annual report on Form 10-K for the year ended August 3, 2024 filed with the Securities and Exchange Commission (the “SEC”) on October 1, 2024 and other filings the Company makes with the SEC, and include, but are not limited to, our dependence on principal customers; the relatively low margins of our business, which are sensitive to inflationary and deflationary pressures and intense competition, including as a result of the continuing consolidation of retailers and the growth of consumer choices for grocery and consumable purchases; our ability to realize the anticipated benefits of our strategic initiatives; changes in relationships with our suppliers; our ability to develop, implement, operate and maintain, and rely on third parties to operate and maintain, reliable and secure technology systems, and the effectiveness of the Company’s business continuity plans in response to an incident impacting the Company’s technology systems, such as the unauthorized incident on its technology systems; labor and other workforce shortages and challenges; the addition or loss of significant customers or material changes to our relationships with these customers; our ability to realize anticipated benefits of strategic transactions; our ability to continue to grow sales, including of our higher margin natural and organic foods and non-food products; our ability to maintain sufficient volume in our Natural and Conventional businesses to support our operating infrastructure; our ability to access additional capital; increases in healthcare, pension and other costs under our single employer benefit plan and multiemployer benefit plans; the potential for additional asset impairment charges; our sensitivity to general economic conditions including inflation, tariff policy and changes in disposable income levels and consumer purchasing habits; our ability to timely and successfully deploy our warehouse management system throughout our distribution centers and our transportation management system across the Company and to achieve efficiencies and cost savings from these efforts; the potential for disruptions in our supply chain or our distribution capabilities from circumstances beyond our control, including due to lack of long-term contracts, severe weather, labor shortages or work stoppages or otherwise; the effect of adverse decisions in, or settlement of, litigation or other proceedings to which we are subject; moderated supplier promotional activity, including decreased forward buying opportunities; union-organizing activities that could cause labor relations difficulties and increased costs; changes in tax laws and regulations, and actions by federal, state and local taxing authorities related to the interpretation and application of such tax laws and regulations; our ability to maintain food quality and safety; and volatility in fuel costs. Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. The Company is not undertaking to update any information in the foregoing reports until the effective date of its future reports required by applicable laws. Any estimates of future results of operations are based on a number of assumptions, many of which are outside the Company’s control and should not be construed in any manner as a guarantee that such results will in fact occur. These estimates are subject to change and could differ materially from final reported results. The Company may from time to time update these publicly announced estimates, but it is not obligated to do so.

Non-GAAP Financial Measures: To supplement the financial information presented on a U.S. generally accepted accounting principles (“GAAP”) basis, the Company has included in this press release the non-GAAP financial measures Adjusted EBITDA, Adjusted EPS, adjusted effective tax rate, free cash flow, net debt to Adjusted EBITDA leverage ratio and Capital and cloud implementation expenditures. Adjusted EBITDA is a consolidated measure which the Company reconciles by adding Net (loss) income including noncontrolling interests, less Net income attributable to noncontrolling interests, plus Non-operating income and expenses, including Net periodic benefit income, excluding service cost, Interest expense, net and Other (income) expense, net, plus (Benefit) provision for income taxes and Depreciation and amortization all calculated in accordance with GAAP, plus adjustments for Share-based compensation, non-cash LIFO charge or benefit, Restructuring, acquisition and integration related expenses, Goodwill impairment charges, Loss (gain) on sale of assets and other asset charges, certain legal charges and gains, and certain other non-cash charges or other items, as determined by management. Adjusted EPS is a consolidated measure, which the Company reconciles by adding Net (loss) income attributable to UNFI plus the LIFO charge or benefit, Goodwill impairment benefits and charges, Restructuring, acquisition, and integration related expenses, gains and losses on sales of assets, certain legal charges and gains, surplus property depreciation and interest expense, losses on debt extinguishment, the impact of diluted shares when GAAP earnings is presented as a loss and non-GAAP earnings represent income, and the tax impact of adjustments and the adjusted effective tax rate, which tax impact is calculated using the adjusted effective tax rate, and certain other non-cash charges or items, as determined by management. The adjusted effective tax rate is calculated based on adjusted net income before tax and excludes the potential impact of changes to uncertain tax positions, valuation allowances, tax impacts related to the vesting of share-based compensation awards and discrete GAAP tax items which could impact the comparability of the operational effective tax rate. Free cash flow is defined as net cash provided by operating activities less payments for capital expenditures. Net debt to Adjusted EBITDA leverage ratio is defined as the total carrying value of the Company’s outstanding short- and long-term debt and finance lease liabilities less net cash and cash equivalents, the sum of which is divided by the trailing four quarters Adjusted EBITDA. Capital and cloud implementation expenditures is defined as the sum of payments for capital expenditures and cloud technology implementation expenditures.