Winning with Private Brands: A Private Label Food Products Success Story

June 5, 2025 8 minute read

Executive Summary

- The case for private brands: private brands can both act as a solution to address the shift in consumer behavior toward a more value-driven shopping approach and differentiate your brand. Private brands are also expected to see significant long-term growth in the coming years.

- A strategic approach to private brands: a private brand strategy should further differentiate your store, help to build your competitive advantage, drive margins, and increase customer loyalty, while aligning with your overall store or brand strategy.

- Bringing strategy to life with Brands+: UNFI’s holistic Brands+ program empowers independent grocers to execute a successful private brand strategy through tailored merchandising, shelf optimization, value-led marketing and innovation—transforming private label from product to strategic growth engine.

- Private brand success story: learn how the team at Uncle Giuseppe’s identified an opportunity to make their stores a premium and Italian specialty item destination by choosing private brands that align with their overall brand, address specific shopper needs and help build customer relationships.

What are private brands?

Private brands, also known as store brands or own brands, are products that are 1) manufactured by a third-party (or sometimes by the retailer themselves); or 2) are sold exclusively under a retailer's own label or brand name. Essentially, instead of selling well-known national brands, a retailer might offer their own versions of those products that are comparable to the national brand1.

Historically, private brands have been seen as lower-quality, cheap affordable alternatives to higher-cost national brands. But today, private brands have evolved to earn their spots on store shelves and now offer trusted choices, proving to shoppers that saving money doesn’t mean sacrificing quality2.

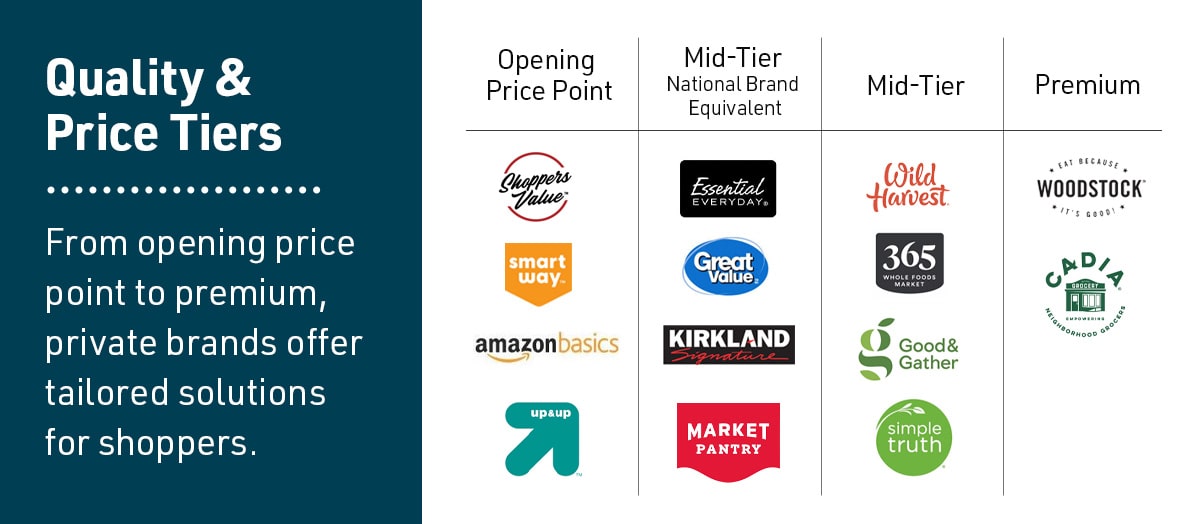

Private brands are more than a one-size-fits-all offering: to best serve shoppers, private brands exist within different quality and price tiers to meet different consumer needs, including Opening Price Point (OPP), Mid-Tier National Brand Equivalent (NBE), Mid-Tier and Premium.

Private brand tiers create a comprehensive ecosystem meeting diverse consumer needs at every price point.

Private brand tiers create a comprehensive ecosystem meeting diverse consumer needs at every price point.

What’s the case for private brands?

Shifting consumer behavior: consumer openness to private label products are at an all-time high; in categories like fresh produce, dairy and condiments, more than half of shoppers either prefer store brands or have no preference between national and store brands, and opportunity exists even within center-store categories like soft drinks and canned soups which have historically been dominated by national brands.

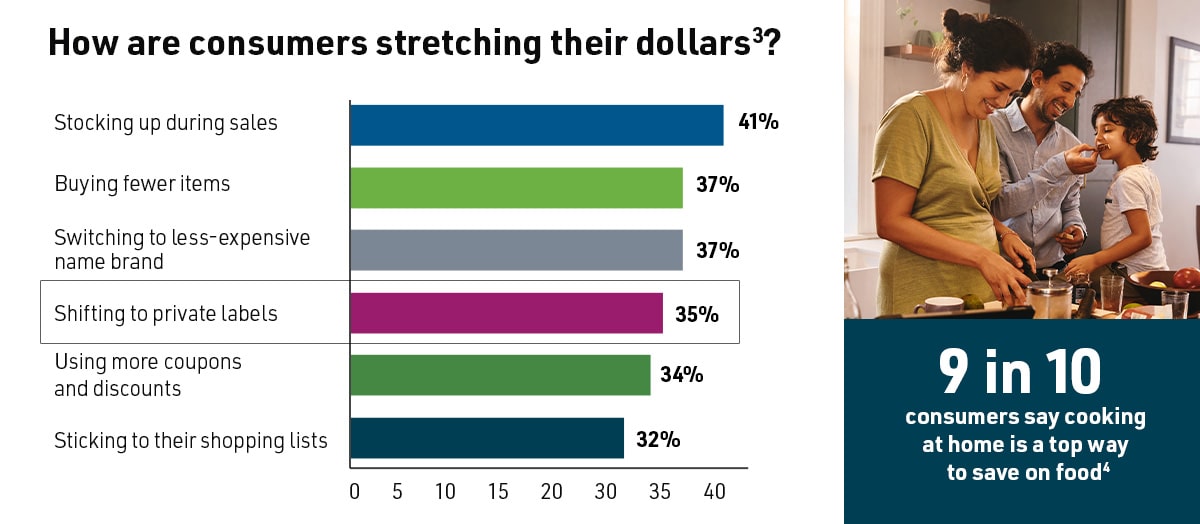

Prices are partially responsible for this trend. As grocery prices have steadily increased, consumers have shifted their grocery shopping behaviors to focus on value, as seen in the chart below based on a consumer survey by R.R. Donnelley & Sons4.

Long-term growth: Over the past 15 years, private label brands have captured an additional seven share points of consumer packaged goods spending5 and global annual value grew 11.2% in 2023 alone6. Looking forward, Mintel estimates a 21% increase in private label sales between 2023-28, from $133.5 billion to $162B7. In short, the growth potential of private label products continues to be a competitive advantage in the industry.

Private brands also provide an opportunity to target Gen Z consumers—a group that is expected to see triple-digit income growth by 2040. Gen Z consumers are highly aware and open to private brands, and often even base their decision of where to shop based on private labels:

- 64% of Gen Z shoppers purchase store brands “always” or “frequently”

- 56% are “extremely likely/likely” to try store brands to find “best value”

- 51% are “always/frequently” choose a place to shop due to its store brands8

Margin(s) driver: The profitability of private label products can be a strong driver of retailer margin. Private brands deliver maximized profit in addition to satisfying consumer needs. Benchmarking a recent study by the Mercator Advisory group, private brands yield 35% profit margins compared to 26% for national brands9. Private Brands not only meet consumer needs, offer competitive value and improve profits. As private brands become more premium, they are expected to deliver even higher margin dollars.

An opportunity to differentiate: As discussed in the previous case study, differentiating with private brands is key for grocers looking to build a competitive edge. Private brands present a unique opportunity to help retailers offer their shoppers a unique product mix and shopping experience to stand out from larger chains and mass retailers. A strategic private brand approach can:

- Increase accessibility of categories for shoppers: private brands can offer a lower-cost alternative to products previously inaccessible to some consumers, increasing basket sizes. The right private brand approach can also encourage shoppers to seek a wider variety of options that cater to different preferences, dietary needs, and lifestyles.

- Fill white space on shelves: private brands can be utilized to capitalize on areas where national brands fall short, including offering better-for-you alternatives, additional flavors, or different pack sizes.

- Build trust with your shoppers: in their search for way to mitigate increase in cost of living, consumers are shifting to a more value-driven approach to grocery shopping, which retailers have capitalized on by offering private label alternatives. In turn, shoppers are becoming more trusting of private labels, fueling momentum and driving a cycle of continued growth.

- Grow your brand: regardless of shoppers’ tendency to reach for private or name brand grocery items, most shoppers indicate that “the quality of a retailer’s store brand reflects the retailer’s overall quality10.

- Be a leader in grocery innovation: private brand innovation is currently outpacing that of national brands, by addressing the growing consumer demand for unique and specialized products that align with their values and preferences11.

Strategic product placement drives customer engagement through thoughtful merchandising decisions.

Strategic product placement drives customer engagement through thoughtful merchandising decisions.

Building a Successful Private Brand Strategy for Retailers

Your private brand strategy should further differentiate your store, help to build your competitive advantage, drive margins and increase customer loyalty. But it’s important to remember your private brand strategy needs to align with and amplify your general retail/brand strategy, so spending time on the “big picture” differentiation first will allow your private brand approach to be more efficient.

To maximize the impact of a private label food products strategy, retailers must focus on five critical components:

- Maximizing assortment. A broad, yet strategic private label product selection ensures customers see private brands as a credible alternative to national brands, enhancing their trust and willingness to purchase. This requires an understanding of category roles and insights into consumer preferences and emerging trends. Retailers should prioritize category coverage that aligns with the purpose of their main customer segments, balancing staple products with premium and specialty offerings to serve their customer needs.

- Merchandising. A competitive merchandising approach, with a focus on Known Value Items (KVIs), ensures private brands drive conversion where it matters most. KVIs—such as milk, bread and eggs—shape price perception and serve as key drivers of store choice. Private brands must be priced competitively against national brands and merchandised strategically to capture shopper attention. Effective tactics include side-by-side placement with national equivalents, compelling shelf tags and multi-tier pricing strategies that cater to different shopper segments.

- Shelf & Display Presence. Appropriate store presence is critical to elevating private brands from an alternative to national brand options. Prioritizing eye-level placement, dedicated brand blocks, and secondary display locations can enhance visibility and trial. Additionally, leveraging endcaps, shippers and in-store signage can reinforce brand positioning and encourage impulse purchases. A strong in-store presence helps solidify the private brand’s role in the overall customer experience and strengthens brand equity over time.

- Value-led Marketing. A strong private brand marketing strategy is essential to shaping shopper perceptions of private brands. Positioning and communication are essential to shaping shopper perceptions of private brands. Beyond traditional price messaging, private brand marketing should emphasize quality, taste and unique attributes to build trust and differentiation. Retailers should leverage digital and in-store touchpoints, including loyalty programs, social media and influencer partnerships.

- Innovation. Finally, robust innovation keeps private brands relevant and competitive. Customers expect private brands to do more than follow—they should lead in key categories by introducing unique flavors, functional benefits, and trend-forward products. A disciplined approach to innovation, informed by market data and consumer insights, ensures a pipeline of differentiated offerings that keep customers returning. Limited-time offerings, exclusive collaborations, and cross-category expansion can further drive excitement and loyalty, positioning private brands as a dynamic alternative to national brands.

From pantry essentials to premium organics: the UNFI Brands+ lineup delivers quality and value across every aisle.

From pantry essentials to premium organics: the UNFI Brands+ lineup delivers quality and value across every aisle.

UNFI Solutions: Brands+

UNFI’s Brands+ program can bring the elements of a successful private brands strategy to life. A holistic private brands program designed to grow independent grocers though differentiation, Brands+ goes beyond assortment to offer tailored merchandising strategies based on product, price and placement on shelf. Our dedicated Sales Partners help retailers build a winning plan that delivers on your growth strategies—meaning Brands+ is far from “just” private brands products and represents a strategic growth opportunity. Below, we’ve highlighted how Brands+ can fulfill on the critical strategic components of a private brand strategy.

Maximizing assortment. As part of a comprehensive grocery private label assortment strategy, including eight core Brands and more than 5,000 Brands+ SKUs, we span every aisle and price point for all your shoppers' needs. The program’s portfolio of offerings can keep any customer engaged:

- Woodstock: The go-to premium brand offering disruptive and trendy organic/non-GMO solutions.

- Equaline: Our preferred and affordable Health and Beauty Aid, Health and Wellness brand, with strong quality and efficacy vs National Brands.

- Essential Everyday: Our quality, foundational mega-brand equivalent products across a robust, margin and value-driving assortment.

- Wild Harvest: An innovative brand of Organic, Non-GMO, Gluten Free product options with accessible high-quality ingredients.

- Culinary Circle: Our category brand for superior frozen pizza offering 17 items across a variety of toppings.

- Stone Ridge Creamery: Our category brand for real ice cream delivering both consumer value and top-notch quality.

- Field Day: Our natural and specialty independent retailer private brand solution across 51 categories.

- Shoppers Value: Our most value driven brand solution across 53 categories.

Merchandising. Through category-level private brand merchandising, Brands+ focuses on driving incremental unit growth, sales and improved value perceptions to help accelerate overall growth in several ways: the KVI program helps retailers position their private brand offerings so consumers can better compare to the national brand, while sales can be maximized by ensuring the “best of the best” assortment on top-selling items.

Shelf & Display Presence. By leveraging merchandising insights and UNFI’s expertise, shelf impact can be maximized, which results in incremental sales. Retailers can partner with UNFI to review assortment strategy by category and build out a joint execution plan that aligns to your overall retail strategy and consumers’ needs.

Value-led Marketing. Several of the Brands+ product lines also offer marketing communication campaigns to support retailer go-to-market strategies with comprehensive marketing toolkits. Essential Everyday, for example, has POS, seasonal and digital media tools available to enhance awareness and improve positioning.

Innovation. Brands+ follows a disciplined approach to innovation, tracking consumer sentiment and market data, and aligning insights from those sources to the appropriate Brands+ product line, assuring consumers have a steady pipeline of new, on-trend products to help you accelerate your sales.

Some recent examples:

- Woodstock Banana Water was created by following key consumer Health & Wellness trends of search for hydration and plant-based products. Utilizing the world’s best-selling fruit, these attributes brought to life the first to market plant-based hydration product that follows the market success of leaders in similar categories like coconut water.

- Essential Everyday zero sugar juice was born out of monitoring the increasing prevalence of diabetes worldwide which has resulted in a higher demand for sugar free beverages, and better-for-you options that don’t sacrifice taste. By assessing zero sugar market trends and finding opportunity in the large-scale shelf stable juice category, we created the product.

Where premium private label strategy meets Italian specialty excellence - transforming center store experiences.

Where premium private label strategy meets Italian specialty excellence - transforming center store experiences.

UNFI Private Label Case Study: Uncle Giuseppe’s

Uncle Giuseppe’s, a specialty grocery retailer with 11 locations across New York and New Jersey, has historically been known for its fresh and store-made prepared food offerings, as well as a differentiated store experience, including opportunities for shoppers to view food preparation and in-store entertainment. To better serve its customers, the team at Uncle Giuseppe’s identified an opportunity to replicate its distinguished perimeter store experience in center store via a private brand strategy to make its stores a premium and Italian specialty item destination.

“We needed to create an ‘own’ brand strategy—something that shoppers come to Uncle Giuseppe’s for. That’s what we’ve done with our own Uncle Giuseppe’s brand as well as Wild Harvest and Woodstock," said Uncle Giuseppe’s President Mike Nelson. “These items have become ‘destination items’ that our shoppers identify with our store.”

Key concerns for the Uncle Giuseppe’s team included choosing the right private brands that align with their overall brand, addressing specific shopper needs and building customer relationships. “Choosing to make strategic changes to our center store with one brand (Wild Harvest) versus a bunch of random natural [national brand] items allowed customers to connect one brand around the store and ultimately increased our sales”, said Nelson.

Integrating the Wild Harvest and Woodstock brands under Uncle Giuseppe’s brand umbrella was a team effort between Uncle Giuseppe’s leadership and the UNFI Brands+ team through promotions, in-store signage and advertising.

When asked what advice he’d give to grocers interested in building a private brand strategy, Nelson told the UNFI team,

“Your private brand strategy has to stand for something. With private brands in our stores, we strive for premium ingredients and quality that our customers can rely on. We understand that our brand is attached to the private label lines we offer. This of course might not be the right strategy for a more value-oriented retailer, but the point is to identify the story you’re trying to tell your customers and build your portfolio around that strategy.”

Ready to elevate your store’s private label food products strategy?

Connect with our team to discover how the UNFI Brands+ program for retailers can drive growth, differentiation and long-term private label profitability.

1Numerator, Top Private Label Brands

2 Kantar, Private Label 101

3Food Business News, Survey: Nearly 90% of Consumers Frustrated Over Grocery Pricing

4Convenience Store News, Consumers Prioritize Cooking at Home as Food Costs Rise

5NIQ, Beyond Price Wars: Unlocking Growth with Private Labels

6Kantar, Private Label 101

7Mintel, Private Label Food & Drink – US 2024

8PLMA Consumer Research Report, Gen Z Loves Store Brands

9Supermarket Perimeter, Study: Margins Higher for Private Label Than National Brands

10Mintel, Private Label Food & Drink – US 2024

11NIQ, Private Label Brand Growth: Key Innovations

Have a Topic Suggestion or Want to Provide Feedback?

Did you find this article helpful or lacking? Or would you like to provide a topic that we can cover in the future? Please take our

short survey.

Credits

Research & Intelligence

- Nathan Tuggle, VP Corporate Marketing

- Neil Savage, Marketing Insights

- Zoë Listro, Marketing Insights

Editorial

- Bruce Bruemmer, VP Brands+

- Patrick Egan, Insights & Category Management